Cris-Tim Family Holding announces the initial public offering between October 17 and 29, 2025, and aims to float on the Regulated Market of BVB

Read the Prospectus before subscribing!

Cris-Tim Family Holding announces the initial public offering between October 17 and 29, 2025, and aims to float on the Regulated Market of BVB

⦁ Cris-Tim Family Holding shares are offered for subscription during October 17 – 29, at a price range of RON 16.5 per share and RON 17.5 per share. Retail investors can subscribe shares at a price of RON 17.5 per share, and during the first 4 working days of the offering they have a 5% discount from the final offering price.

⦁ The offering will include both a component of the sale of existing shares by the majority shareholder and a component of the sale of newly issued shares as part of a capital increase, with the majority of the amount raised in the initial public offering to be used to finance the company’s development plans.

⦁ In the event of the successful closing of the initial public offering, the Company’s free-float will be a maximum of 35% of the share capital.

⦁ The Company is a market leader in the cold cuts and ready-meals production markets, being one of the most important operators in the food industry in Romania, recognized by its main brands, “Cris-Tim”, “Matache Măcelaru'” and “Bunătăți”.

⦁ As a future listed company, Cris-Tim aims to consolidate its market positions both through organic growth supported by a major investment program of RON 890 mn during the period 2025-2030, and through the acquisition of active players in the sectors in which it operates.

Bucharest, October 16, 2025 – Cris-Tim Family Holding (“Cris-Tim”, or the “Company”), the leader in the Romanian cold cuts and ready meal markets, announces the approval by the Financial Supervisory Authority („ASF”), on October 15, 2025, of the Prospectus for the initial public offering of up to 27,066,667 shares. The offering is taking place between 17 and 29 of October 2025 and involves the sale of existing shares by Rangeglow Limited and the issuance of new shares as part of a share capital increase of Cris-Tim Family Holding. In the event of the successful closing of the initial public offering, Cris-Tim will apply for admission to trading of all issued shares on the Regulated Market of the Bucharest Stock Exchange (“BVB”), Premium category, under the stock ticker CFH.

The funds raised through the initial public offering, both those obtained from the subscription of new shares (part of the share capital increase) and those obtained from the sale of existing shares, will be used in significant proportion to support Cris-Tim’s investment plans.

The selling shareholder, Rangeglow Limited, will use part of the funds from the offering to repay loans granted by the Company in the amount of EUR 57.3 mn, equivalent to RON 290.8 mn (including interest) accrued until August 31, 2025, (plus any additional amounts resulting from new loans, new drawdowns under existing arrangements, as well as from interest accruals up to the date of the Prospectus, within the limit of the EUR equivalent of RON 306 mn), following the reorganisation and consolidation of intra-group debts. The Company will use the funds obtained from the offer (i.e. both those obtained from the subscription of new shares, as well as those received from the selling shareholder according to the details above) to support its investment plans. For more information on the structure of the initial public offering, the destination of the funds raised and the Company’s investment plans, please consult the dedicated sections of the Prospectus.

For the period 2025 – 2030, Cris-Tim is considering an investment plan in the amount of RON 890 mn, of which RON 768 mn are allocated to the cold cuts segment, and RON 121 mn are allocated to the ready-meals segment and other investment objectives. Part of this investment plan is focused on developing existing production capacities, a program partially financed by the national program for revitalizing the agri-food industry, Investalim. The investment program will be implemented between 2025 and 2028, with the financing agreement signed on October 8, 2024, by the Agency for Financing Rural Investments (“AFIR”).

In addition to the organic growth objectives, the Company intends to identify merger and acquisition targets in the coming years, with the aim of strengthening its competitive position in the cold cuts and ready-meal markets, as well as diversifying its product portfolio.

The Company intends to distribute a minimum of 50% of the annual individually distributable net profit as ordinary dividends.

In the context of the approval of the Prospectus for the initial public offering of Cris-Tim Family Holding, Mr. Radu Timiș Jr., CEO of Cris-Tim, states:

“Cris-Tim Family Holding is a Romanian entrepreneurial company that has constantly developed over its 33 years of activity, confirming its leading position in the cold cuts and ready meals markets. Innovation and the superior quality of our products have been and will always be the main pillars of our operations.

We created the unique Clean Label concept, launched new categories ahead of time, from raw dried to ready meals and sliced cold cuts, and demonstrated that the entire industry can be transformed through vision, responsibility and care for consumers. Today, our emblematic brands – “Cris-Tim”, “Matache Măcelaru'” and “Bunătăți” – reach the tables of millions of consumers every day, both in the country and abroad.

Our investment and development plans will allow us to reach a new level of performance in terms of production standards, efficiency and quality, and to become a benchmark of excellence for the South-Eastern European region. At the same time, we are targeting a series of products from competitors, both locally and regionally, in order to increase our commercial footprint and access new categories of products with added value, perfectly completing the existing portfolio. From today, all those who are our consumers and appreciate our products have the opportunity to invest with us, to be part of the continuation of this Romanian success story”.

The availability of the Cris-Tim Family Holding Prospectus

Banca Comercială Română S.A. and BRD – Groupe Société Générale S.A. are acting as Joint Lead Managers in connection with the offering. The prospectus and all the related documents are available on the web page of Cris-Tim Family Holding, www.cristim.ro.

The Prospectus is also available on the website of Banca Comercială Română S.A., www.bcr.ro, and on the website of the BVB at www.bvb.ro. Copies thereof will be provided upon request during normal business hours at the headquarters of Banca Comercială Română S.A., located at 15D Orhideelor, The Bridge 1 building, 2nd floor, 6 district, Bucharest, and at the headquarters of BRD – Groupe Société Générale S.A., located ar BRD Tower, 1-7 Ion Mihalache, Bucharest, as well as through the network of branches dedicated to the offering of BCR and BRD.

Details about the initial public offering

The initial public offering of Cris-Tim Family Holding consists of the sale of a maximum of 20,866,667 existing shares by Rangeglow Limited, controlled by the founding entrepreneurs, Radu and Cristina Timiș, as well as a subscription offer of up to 6,200,000 newly issued ordinary shares of the Company, the share capital increase component through the issuance of new ordinary shares. Additionally, the offering also includes an Over-Allotment option, to allow for stabilization measures, if necessary, according to the Prospectus. The shares are offered at the offering price range of RON 16.5 per share and RON 17.5 per share, and the estimated free float of the Company on the BVB, after the closing of the offering and listing, is a maximum of 35%.

The offering is divided into two tranches intended for retail investors in Romania and institutional investors outside the United States of America, based on Regulation S under the Securities Act. The final size of each tranche will be determined based on the level of subscriptions received from investors, after the end of the offering period.

The retail investor tranche represents 15% of the offering, i.e. up to 4,060,000 shares. Retail investors can subscribe for shares at the fixed price of RON 17.5 per share, i.e. the upper limit of the offering price range, and are entitled to a 5% discount on the final offering price for subscriptions during the first 4 working days of the offering, i.e. from October 17 to October 22, 2025. The minimum subscription for a retail investor is at least 300 shares. Depending on the level of the final offering price, the reduced final offering price may be below the lower level of the offering price range.

The institutional investor tranche represents 85% of the offering, or 23,006,667 shares, to institutional investors outside the United States of America under Regulation S. Institutional investors may subscribe at any price within the offering range. The final offering price at which the offered shares will be allocated to institutional investors will be determined after the close of the offering period and will be made public on the allocation date, which is October 30, 2025.

Retail investors may subscribe for the shares offered throughout the entire offering period, during the normal working hours of Banca Comerciale Romane S.A. and BRD – Groupe Société Générale S.A., at the headquarters and through the network of branches dedicated to the offering. Subscriptions may also be made through intermediaries authorized by the Bucharest Stock Exchange, except for the last business day of the offering period (i.e. October 29, 2025), when subscriptions will be accepted only until 12:00, Romanian time.

Cris-Tim Family Holding, leader in the Romanian cold cuts and ready-meals markets

Cris-Tim is a Romanian entrepreneurial company founded in 1992, which in its 33 years of existence has grown both organically and through acquisitions, from a start-up to the leader in the cold cuts and ready-meals markets. The Company has gradually consolidated both its market share in its target sectors and its profitability through substantial investments in technology and logistics, innovation, focus on product quality, competitiveness in raw material procurement policy, development of strong brands, high level of staff commitment and retention.

In 2024, Cris-Tim recorded revenues from customer contracts of RON 1.12 bn (+7.1% compared to 2023), EBITDA of RON 166.8 mn (+8.1%) and net profit from continuing activities of RON 84.7 mn (+3%). The company ended the first half of 2025 with EBITDA of RON 86.2 mn (+12.4%) and net profit of RON 47.5 mn (+29.1%) compared to the same period in 2024.

The cold cuts segment is the company’s main business line with a share of at least 86% in revenue from customer contracts in the period 2022 – 2024 and 88% in the first semester of 2025. The Ready-Meals segment is the company’s second business line with a share of at least 9.4% in revenue from customer contracts in the period 2022 – 2024 and 10.6% in the first semester of 2025. The company ended the first semester of 2025 with revenue from customer contracts related to the two main business lines of RON 527.1 mn (+4.25% compared to the same period in 2024).

“At the end of 2024, the company occupied the market leader position in the cold cuts production sector by sales volume, 10.6%, and 14.3% by sales value. It is a result that makes us happy and motivates us to become better and more efficient both from an operational and financial perspective. Our plans to consolidate our market position include, on the one hand, investments in the development of the main factory in Filipeștii de Pădure, as well as the acquisition of other market players in the cold cuts and ready-meals segments”, said Răzvan Furtună, CFO of Cris-Tim Family Holding.

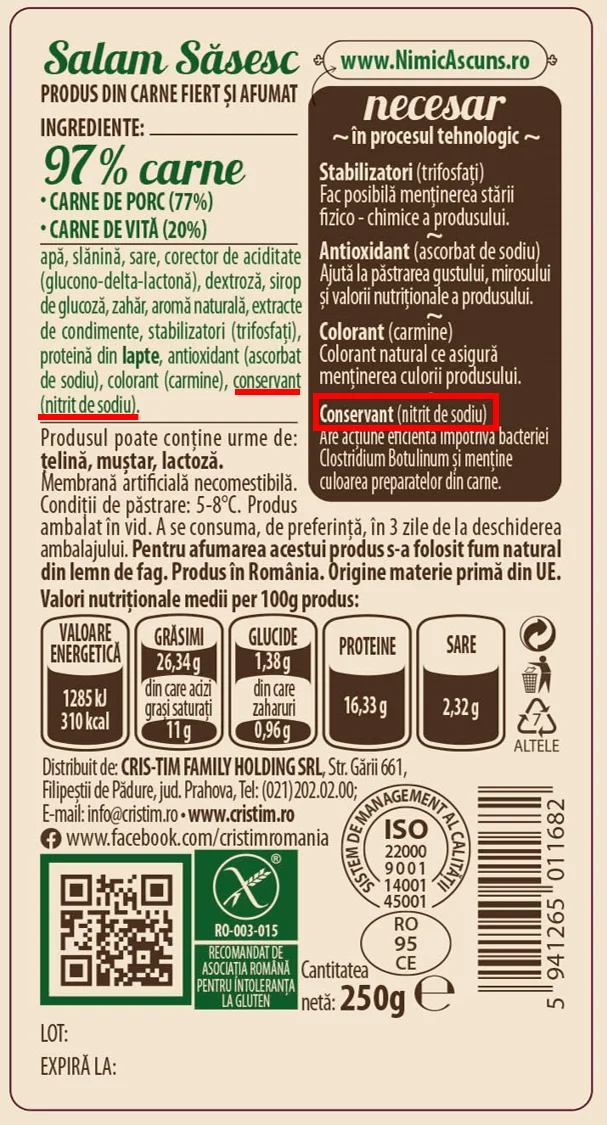

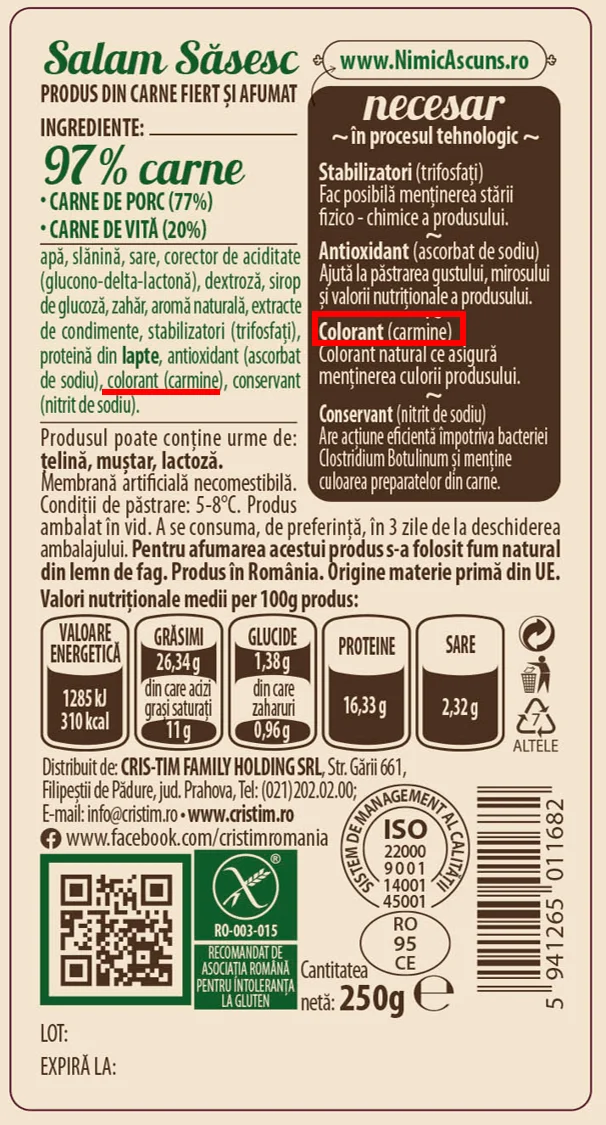

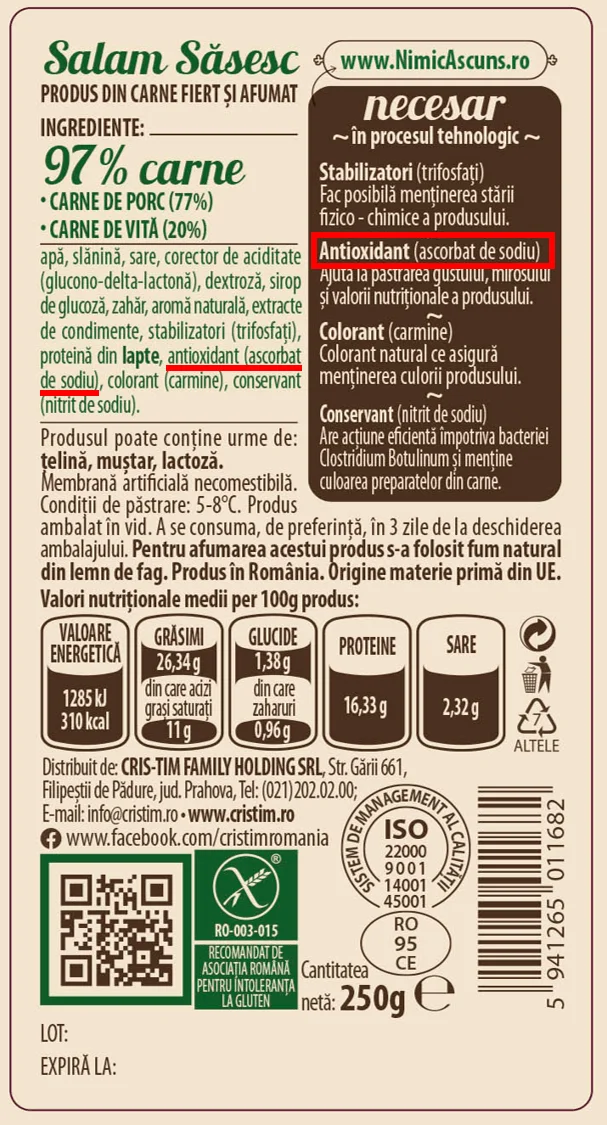

Cris-Tim is present in the retail market with the Cris-Tim, Matache Măcelaru’, Alpinia, Obrăjori, and Csárdás meat product brands, as well as the Bunătăți ready meals brand. At the same time, it is an emerging producer in the private label production segment for large international modern retail chains. The Cris-Tim brands are among the most prominent in the food industry and among the best known to Romanian consumers, supported by intensive and appropriately calibrated marketing and advertising programs. Cris-Tim’s flagship product is Salam Săsesc, launched under the Cris-Tim brand in 2002, which subsequently became the main catalyst for the company’s accelerated sales growth. Cris-Tim brands are present on the shelves of all 13 retail chains operating in Romania, as well as in over 15,000 traditional stores. The Company also has 18 of its own stores and exports its products to 17 European countries.

Through the “Clean Label” concept launched in Romania for the first time in 2017, Cris-Tim has proven to be the most innovative company in terms of quality. “Clean Label” has revolutionized the meat processing industry by radically changing the perception of quality, thus creating a new perspective of sustainable development for the entire industry. The “Clean Label” concept involved explicitly committing to ensuring a high level of product quality (drastically limiting the number of ingredients or additives that could harm consumers’ health in the long term). Products in the Cris-Tim portfolio with the “Clean Label” contain up to a maximum of four additives versus a market average of 9-11.

Cris-Tim is currently one of the largest companies operating in the agri-food sector in Romania, with production capacities aligned with modern technologies. The Company operates three factories with a combined capacity of 215 tons/day, the main factory operated by Cris-Tim being the one in Filipeștii de Pădure, with a production area of 50,000 square meters and a technological capacity of 165 tons of products per day. This factory exclusively produces cold cuts under the Company’s main brands, Cris-Tim and Matache Măcelaru’, which are fully aligned with the “Clean Label” concept, as well as ready-meals made from meat. The Măgureni factory has a production area of 6,000 square meters and a daily production capacity of 25 tons, which is allocated to the production of cold cuts under the Alpinia economy brand and the production of cold cuts under private labels. The Bucharest factory is dedicated exclusively to the production of ready meals (soups, stews, salads, menus), with a production area of 2,200 square meters and a technical capacity of 25 tons per day.

Cris-Tim operates an extensive logistics infrastructure that includes nine large cold storage warehouses nationwide and an own fleet of commercial and utility vehicles used for distribution to modern retail chains and traditional stores. Cris-Tim has over 2,000 employees, approximately half of whom have been with the Company for over seven years.

For more information, please contact:

CRIS-TIM FAMILY HOLDING S.A.

Zuzanna Kurek, [email protected], 0742431111

Rogalski Damaschin Public Relations

Natalia Negru Botezan, [email protected], 0742521586

DISCLAIMER – IMPORTANT NOTICE

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN THE UNITED STATES, CANADA, JAPAN OR AUSTRALIA

This press release does not constitute an offering to sell or a solicitation of an offering to buy any securities in any jurisdiction and is not a prospectus within the meaning of the Prospectus Regulation. Investors should not subscribe for or purchase any securities referred to in this press release except based on the information contained in the final Prospectus.

The approval stamp applied on the public offering Prospectus does not represent a guarantee or any type of appraisal by the FSA as regards the opportunities, advantages or disadvantages, profits or risks involved by the transactions to be concluded following the acceptance of the public offer subject of the approval decision. The approval decision certifies only that the Prospectus complies with the requirements of the law and of the norms adopted in its application.

This press release does not constitute an offering for sale of securities in the United States. The securities to which this press release refers have not been registered under the U.S. Securities Act of 1933, as amended (the “Securities Act”) and may not be offered or sold in the United States. There will be no public offering of securities in the United States.

In the Member States of the European Economic Area, this communication is addressed only to persons who are “qualified investors” within the meaning of Article 2(e) of the EU Prospectus Regulation (Regulation (EU) 2017/1129). This communication is not an advertisement within the meaning of the applicable measures implementing the EU Prospectus Regulation. In accordance with the requirements of Directive 2014/65/EU, the information contained in this communication is addressed exclusively to eligible and professional counterparties, regardless of the distribution channels.

Cris-Tim has not authorized any offering of securities to the public in any Member State of the European Economic Area other than Romania. In respect of each Member State of the European Economic Area other than Romania that has implemented the EU Prospectus Regulation (each, a “Relevant Member State”), no action has been taken or will be taken to make an offering of securities to the public that requires the publication of a prospectus in a Relevant Member State. Accordingly, securities may only be offered in the Relevant Member States to a legal entity that is a qualified investor as defined in the Prospectus Regulation; to fewer than 150 natural or legal persons per Relevant Member State (other than qualified investors as defined in Article 2(e) of the Prospectus Regulation), subject to obtaining the prior consent of the Mandated Co-Arrangers for any such offering; or in any other circumstances falling within the scope of Article 1(d) of the EU Prospectus Regulation, provided that no such offer of securities requires the publication by Cris-Tim, the shareholders of Cris-Tim or any of the Mandated Co-Arrangers of a Prospectus pursuant to Article 3 of the Prospectus Regulation or a supplement to the Prospectus pursuant to Article 23 of the Prospectus Regulation. For the purposes of this paragraph, the expression “offering of securities to the public” in any Relevant Member State means the communication, in any form and by any means, of sufficient information about the terms of the offering and the securities to be offered, so as to enable an investor to decide to purchase any securities, as they may vary in that Member State by any implementing measure of the EU Prospectus Regulation, and the expression “EU Prospectus Regulation” means Regulation (EU) 2017/1129 and includes any relevant implementing measure in each Relevant Member State.

The approval of the Prospectus does not constitute a guarantee or any kind of assessment by the ASF regarding the opportunity, advantages or disadvantages, profit or risks involved in accepting the Offering, which is the subject of the approval decision; the approval only certifies the compliance of the Prospectus with the legal requirements and the rules adopted for its application.